Strong Assistance: Trust Foundations You Can Trust

Strong Assistance: Trust Foundations You Can Trust

Blog Article

Guarding Your Properties: Depend On Foundation Expertise within your reaches

In today's complex economic landscape, ensuring the safety and security and development of your assets is vital. Trust fund structures serve as a foundation for protecting your riches and legacy, giving a structured approach to asset protection.

Significance of Count On Foundations

Count on foundations play an important function in establishing trustworthiness and promoting strong connections in different professional settings. Structure trust fund is crucial for organizations to grow, as it develops the basis of successful collaborations and partnerships. When trust fund exists, people feel more confident in their communications, causing boosted productivity and efficiency. Trust fund structures work as the cornerstone for moral decision-making and transparent communication within companies. By focusing on count on, businesses can develop a positive work society where workers really feel valued and appreciated.

Benefits of Professional Assistance

Building on the foundation of count on in expert connections, seeking expert assistance provides important benefits for individuals and organizations alike. Specialist advice gives a wide range of expertise and experience that can assist navigate complex financial, lawful, or critical obstacles effortlessly. By leveraging the know-how of experts in different fields, people and companies can make educated choices that straighten with their goals and goals.

One significant advantage of professional assistance is the ability to gain access to specialized expertise that might not be easily available or else. Professionals can offer understandings and point of views that can lead to innovative remedies and chances for growth. In addition, dealing with experts can aid reduce risks and unpredictabilities by providing a clear roadmap for success.

In addition, professional guidance can conserve time and resources by enhancing processes and staying clear of costly blunders. trust foundations. Professionals can supply customized advice tailored to specific requirements, ensuring that every decision is educated and tactical. On the whole, the benefits of professional guidance are diverse, making it a beneficial asset in securing and taking full advantage of properties for the long-term

Ensuring Financial Safety

In the realm of monetary preparation, safeguarding a secure and prosperous future rest on tactical decision-making and prudent financial investment our website selections. Making certain economic security involves a multifaceted method that includes different elements of riches administration. One critical component is developing a varied financial investment profile customized to specific danger resistance and monetary goals. By spreading investments across different asset courses, such as supplies, bonds, actual estate, and assets, the danger of considerable monetary loss can be reduced.

Furthermore, maintaining a reserve is crucial to secure against unexpected expenditures or earnings disruptions. Specialists suggest reserving three to 6 months' worth of living expenditures in a liquid, conveniently available account. This fund serves as an economic safeguard, supplying peace of mind throughout rough times.

Routinely assessing and changing economic plans in feedback to altering circumstances is likewise paramount. Life occasions, market variations, and legislative adjustments can impact economic stability, highlighting the importance of continuous examination and read more adaptation in the search of long-term monetary security - trust foundations. By carrying out these strategies thoughtfully and constantly, individuals can fortify their monetary ground and work towards an extra protected future

Protecting Your Properties Effectively

With a solid structure in position for financial safety via diversity and reserve maintenance, the following essential step is guarding your possessions efficiently. Guarding assets involves safeguarding your riches from possible threats such as market volatility, financial downturns, suits, and unexpected costs. One efficient approach is property appropriation, which involves spreading your investments across various asset classes to reduce risk. Diversifying your portfolio can help alleviate losses in one area by stabilizing it with gains in one more.

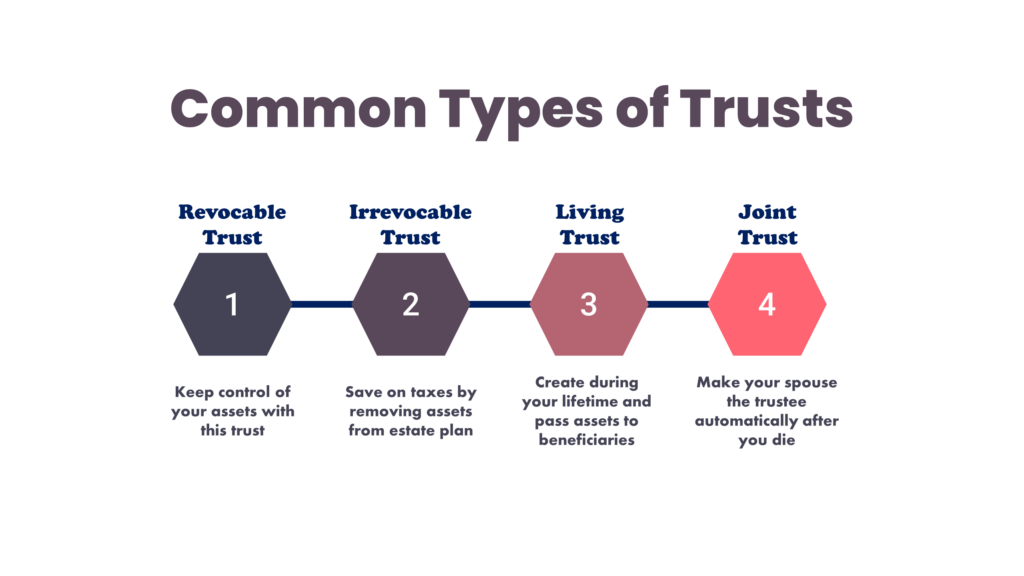

Additionally, developing a trust can supply a protected means to secure your assets for future generations. Depends on can help you manage how your possessions are distributed, reduce estate tax obligations, and secure your wide range from lenders. By applying these techniques and looking for professional recommendations, you can safeguard your possessions properly and secure your monetary future.

Long-Term Property Protection

Long-lasting possession security includes executing steps to protect your assets from various threats such as financial declines, claims, or unforeseen life events. One essential aspect of lasting property security is establishing a trust, which can offer substantial benefits in protecting your assets from financial institutions and lawful disputes.

Moreover, expanding your financial investment portfolio is an additional crucial method for long-term property security. By spreading your investments throughout different asset courses, markets, and geographical areas, you can minimize the impact of market variations on your general wealth. In addition, frequently reviewing and upgrading your estate plan Click Here is necessary to make sure that your assets are shielded according to your wishes over time. By taking a positive approach to long-lasting possession defense, you can protect your wide range and offer economic safety and security for on your own and future generations.

Conclusion

In final thought, depend on structures play a vital duty in guarding properties and making certain economic protection. Specialist advice in developing and taking care of depend on frameworks is vital for long-lasting possession protection.

Report this page